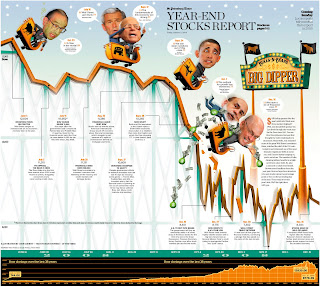

US MARKET BLOODBATH

Posted by jov3n- trader202 on Thursday, August 11, 2011 Under: Investing

There are a multitude of reasons behind the stock market plunge in the US that led to the 9th biggest point drop in the history of the Dow Jones index. Below is a brief discussion of these reasons.

There are a multitude of reasons behind the stock market plunge in the US that led to the 9th biggest point drop in the history of the Dow Jones index. Below is a brief discussion of these reasons.1. Weakening U.S. economy – Recent GDP data show that the US expanded by less than 1% in the first half of the year. Industrial activity is likewise slowing, as evidenced by weak PMI and ISM numbers. All these, plus lower consumer spending all pointed to a weakening economy, bringing about talks of a double dip recession.

2. Dysfunctional politics – The political gridlock, the grandstanding of the politicians and the disappointing debt ceiling compromise was met with disgust and disappointment. This was elucidated by the words of PIMCO CEO Mohamed El-Erian when he said that “the stunning political dysfunctionality was exposed by the debt ceiling debacle.” In the words of the S&P, “the effectiveness, stability and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges.”

3. Uncertainty – As a result of the brinksmanship in Washington, the product was a piece of legislation that did not address the long term deficit issues of the US. Instead of coming up with $4 trillion in savings that would have pointed the economy in the proper direction, the package would reduce the deficit by only $2.1 trillion over 10 years. Instead of taking the bull by the horns as the Philippines did (see Staying the Course of Reforms, 31 July 2006), the US has delayed the resolution of the problem. In this case, time does not heal wounds. Rather, it makes it deeper. Uncertainty is anathema to the stock market.

4. Anticipated credit rating downgrade – The repeated warnings of the ratings agencies caused the markets to be jittery. Obama’s speeches and the repeated torpedoing of each proposal to address the budget deficit did little to calm the frazzled nerves of investors. These warnings finally came to fruition when the S&P downgraded US debt. The S&P said that “the downgrade reflects our opinion that the fiscal consolidation plan that Congress and the administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government's medium-term debt dynamics.”

5. Lack of confidence – The outcome of the debt ceiling debate in Congress has caused investors to lose confidence in their leaders. Seeing that the bullheadedness of policymakers and their uncompromising hardline stance would be of no help to the economy, investors acted accordingly and sold their holdings. Moreover, perception that the Fed is out of bullets meant that not only would QE3 be ineffective, but that now, no one can rescue the economy from its malaise.

6. European contagion effect – Further complicating the matter is the debt crisis in Europe that has threatened to engulf Spain and even Italy, the EU’s 3rd biggest economy. To put it in perspective, note that the economies of Greece, Ireland and Portugal combined amount to only about 1/3 of that of Italy. Yet, these roiled the markets as each unfolded.

7. Technical chart breakdown – Charts of stock market indices in the US, Europe and other major countries show a technical breakdown. Various bearish patterns have been emerging, like the S&P 500 which broke down from a head and shoulders top. This triggered stop losses which caused traders who use technical analysis to sell their positions.

8. Risk-off trades – All the macro headwinds and uncertainties have caused portfolio managers to take risks off the market. Many investors sold all perceived risky assets, like equities, bonds and commodities. They sought the safety of cash and gold. This even prompted the Bank of New York Mellon to charge penalty fees for large cash deposits.

The big difference now between Asian economies, including the Philippines, and the US is that while they continue with their profligate ways, we have learned our lesson from the Asian financial crisis. Asian economies now have good fiscal discipline, which has partially insulated them from the financial turmoil in the developed world. For instance, the US reached the ceiling in terms of its borrowing. On the other hand, the Philippines’ budget deficit is way below the cap set by the government.

U.S. Political Gridlock versus Enlightened Philippine Government. While the Democrats and Republicans are wrangling on ways to revive their flagging economy, our legislators and leaders have gotten their act together. The Bangko Sentral ng Pilipinas (BSP) is doing its part in controlling inflation by raising interest rates in line with inflation figures while, at the same time, controlling inflows of hot money into the country. The executive branch and the Department of Finance is closely watching the deficit and ensuring that it remains below the targets they have set.

As far as legislation is concerned, constitutional amendments covering economic statutes are now on the table. Lifting foreign ownership limits on mining, utilities, media companies and land is a step in the right direction and a bullish signal for the stock market.

Philippine Stock price movement is also highly affected for three consecutive days now. (source: wealthsec)

In : Investing

Tags: us market market crash stock market stock price movement tips philippine market debt finance target

blog comments powered by Disqus