OUR TIME IS NOW!

Posted by jov3n- trader202 on Thursday, July 28, 2011 Under: Investing

Over the past few weeks, the US has been wrestling with a crippling budget deficit as well as a potential default. If a new policy on the country’s debt ceiling is not agreed upon by the politicians before August 2 (exactly 8 days from today), we might just witness a US default for the first time in history. A looming downgrade by credit ratings agencies on US debt is also a distinct possibility. A continent away, European leaders are brainstorming on how to pull the region out of a potential debt contagion. With the 3 out of 5 PIIGS (Portugal, Italy, Ireland, Greece and Spain) being the subject of detrimental credit rating downgrades, both the Euro and European stock markets have seen heavy selling pressure. Financial institutions across the developed countries are also losing their veil of stability which, until 2008, was all but unquestionable. This created the volatility we experienced during the first half of 2011.

Over the past few weeks, the US has been wrestling with a crippling budget deficit as well as a potential default. If a new policy on the country’s debt ceiling is not agreed upon by the politicians before August 2 (exactly 8 days from today), we might just witness a US default for the first time in history. A looming downgrade by credit ratings agencies on US debt is also a distinct possibility. A continent away, European leaders are brainstorming on how to pull the region out of a potential debt contagion. With the 3 out of 5 PIIGS (Portugal, Italy, Ireland, Greece and Spain) being the subject of detrimental credit rating downgrades, both the Euro and European stock markets have seen heavy selling pressure. Financial institutions across the developed countries are also losing their veil of stability which, until 2008, was all but unquestionable. This created the volatility we experienced during the first half of 2011.Clipping the Dragons’ Wings: The 1997 Asian Financial Crisis. Similar to what we are now seeing in Europe, specifically the PIIGS, Asia itself went through its own troubled era. Towards the end of the 20th century, however, Asia itself was battered by a financial crisis. Back in 1996, the Philippine peso was trading at about PhP 26 to the dollar. By 1998, the peso had depreciated to 46 pesos to the dollar. The Philippine Stock Exchange index suffered just as severely, falling nearly 70% to just a little above the 1,000-level. The same bloody mess could be seen across the ASEAN nations, necessitating a bailout from the IMF, World Bank and developed countries around the world. From being called Asian tigers or rising dragons, and gracing the front pages of magazines such as Time and Newsweek, we were reduced to mendicants whose policies were looked down upon by the Western world.

Reversal of Fortune: The 2007 US Financial Crisis. For years, we were lectured on how to run our financial affairs by our richer counterparts and encouraged to enact cost-cutting measures. A decade after the beginning of the financial crisis though, it was the teacher’s turn to become a student. In 2007, the US experienced a crisis that all but wiped out the American Dream. As a result of subprime mortgages going under, not only were many people deprived of homes, but many financial institutions invested in these supposedly uncorrelated and therefore “safe” instruments went under. Foremost of the fallen giants were Lehman Brothers (founded in 1850) and Bear Stearns (founded in 1923). Unfortunately, the crisis did not end there, with the US still dealing with the resulting fallout.

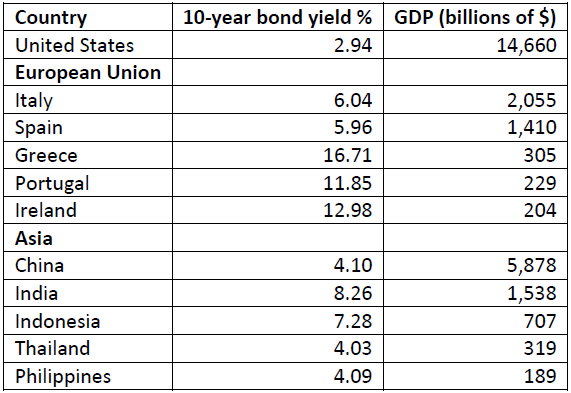

Reversal of Fortune: The 2007 US Financial Crisis. For years, we were lectured on how to run our financial affairs by our richer counterparts and encouraged to enact cost-cutting measures. A decade after the beginning of the financial crisis though, it was the teacher’s turn to become a student. In 2007, the US experienced a crisis that all but wiped out the American Dream. As a result of subprime mortgages going under, not only were many people deprived of homes, but many financial institutions invested in these supposedly uncorrelated and therefore “safe” instruments went under. Foremost of the fallen giants were Lehman Brothers (founded in 1850) and Bear Stearns (founded in 1923). Unfortunately, the crisis did not end there, with the US still dealing with the resulting fallout.From Investment Grade to Junk: The European Debt Crisis. The European debt crisis, which is currently unfolding, brings back memories of the Asian financial crisis. Isolated only to the Eurozone, debt yields spiked and the Euro weakened as a result of concerns over the ability of sovereign states to service their debt. To date, 3 Eurozone countries have already asked for bailout funds, namely, Greece, Portugal and Ireland. Just like the ASEAN countries then, these countries were given loans on the condition that they pass austerity measures that would reduce their government’s budget deficit and allow for the timely payment of debt. Unfortunately, as a result of their near-term illiquidity, borrowing costs for these countries skyrocketed, further exacerbating their problems. See below a table of the corresponding yields on 10-year debt of the developed and emerging nations:

10 years or so ago, no one could have imagined that the Philippines would have a lower 10-year bond yield than Italy or Spain, developed countries whose economies are more advanced than ours.

Irony of ironies. After saving emerging markets more than a decade ago, it is quite ironic that developed markets are now trying to emulate how their Asian counterparts keep their fiscal house in order. As a result of their debt debacle, it is now impossible for developed countries to be the role models for the rest of the world. As for the emerging markets, from being pariahs, we have become the drivers of world GDP growth as a result of good demographics and better fiscal policies.

Major trends continue for years or even decades. Just as kingdoms are not built in a day, they do not fall overnight. Assuming the policies of a country are sound, then uptrends for currencies and capital markets will continue on for decades before reversing. For instance, since the 1970s, the US was on a near uninterrupted uptrend which lasted for about 3 decades before getting derailed by the tech bubble and the financial crisis. Emerging markets in both Asia and Latin America were prone to boom-bust cycles in the past. But over the past few years, the Asian region has been viewed as a bastion of fiscal responsibility and discipline, thereby attracting foreign investors seeking stable and better returns.

Newton’s First Law of Motion. According to Isaac Newton’s law of inertia, an object in motion continues in motion with the same speed and the same direction unless acted upon by an unbalanced force. The same is true for the stock, bond, and foreign exchange markets. Once proper factors are in place, these markets will embark on an uptrend which, if unimpeded by any crisis or negative change in external and internal conditions, will persist for as long a time as the factors which brought it about remain. This concept is the basis for our strong recommendation for a long term investment in the Philippine stock market which we have been harping on for years. The reasons that our country has remained resilient are outlined in last week’s article (PSEi, all-time high, 18 July 2011).

Our time is now. Why should investors look for opportunities elsewhere? Why invest in derivatives or other exotic instruments and European bonds which your banker suggests when the best returns can be found right at your doorstep? The most profitable investments are right here in Asia, specifically, the ASEAN countries, including the Philippines. Moreover, as mentioned in last week’s article, ASEAN is the way to go with fund flows now moving from developed markets to ASEAN markets such as Singapore, Thailand, Indonesia, Malaysia and the Philippines. Our better fiscal performance relative to the more developed Western countries caught the eye of foreign investors and, as a result, has fuelled the recent stock market and currency surge, which are both reaching new highs. Bangko Sentral ng Pilipinas Governor Amando Tetangco, Jr. even remarked that the flow of foreign funds into ASEAN countries may even accelerate in the event of a US credit rating downgrade. From being shunned because of excessive volatility, ASEAN now represents stability and growth. Given that, investors, both foreign and local alike, should invest in the Philippine equity market. Our time is now.

Our time is now. Why should investors look for opportunities elsewhere? Why invest in derivatives or other exotic instruments and European bonds which your banker suggests when the best returns can be found right at your doorstep? The most profitable investments are right here in Asia, specifically, the ASEAN countries, including the Philippines. Moreover, as mentioned in last week’s article, ASEAN is the way to go with fund flows now moving from developed markets to ASEAN markets such as Singapore, Thailand, Indonesia, Malaysia and the Philippines. Our better fiscal performance relative to the more developed Western countries caught the eye of foreign investors and, as a result, has fuelled the recent stock market and currency surge, which are both reaching new highs. Bangko Sentral ng Pilipinas Governor Amando Tetangco, Jr. even remarked that the flow of foreign funds into ASEAN countries may even accelerate in the event of a US credit rating downgrade. From being shunned because of excessive volatility, ASEAN now represents stability and growth. Given that, investors, both foreign and local alike, should invest in the Philippine equity market. Our time is now.(source: PhilEquity, PhilSec)

In : Investing

Tags: invest pse stock market philippines asean market investment stock investment stock shares debt bangko sentral equity time

blog comments powered by Disqus